Ocean Transportation update as of 7th January 2024

Dear Partners,

Following our previous announcements, pls find underneath a few updated highlights on the Red Sea situation and the ocean carriers:

Evergreen and OOCL do no longer accept any bookings for cargo with destination Israel / Israeli receiver – as a preventive action not to get in focus by the Houthi rebels.

The M/V Maersk Hangzhou was attacked twice on the same journey in the Red Sea (last attack on 31st Dec’23). They sent a distress call to the US Navy while the rebels tried to enter the containership by four small boots. The rebels were armed and shooting onto the vessel and came close as 20 meters. The rebels also shoot on the approaching US Navy helicopter. As a matter of self-defense, the US Navy destroyed three out of the four rebel boats and killed 10 people. The fourth rebel boat was able to escape. No harm to the Navy troops or the Maersk seafarer. Based on this event, Maersk decided to stop all passages through the Suez for the time being and to have their vessels operating via the Cape of Good Hope.

Carriers are stringently implementing surcharges due to the overall increased cost situation, while operating via South Africa. Same time we also see surcharges implemented in trades which have no direct link to the Red Sea – such as Transatlantic or Transpacific. Carriers argue with the ripple effect on port congestion and equipment constraints because of the COGH routing. By our reading it is obvious that the carriers make use of the opportunity to lift the freight rate levels into a healthier situation for them. There is an overall uncertainty in the market, that we are heading into another massive supply chain disruption scenario – similar like the Suez blockage by the Ever Given (only 6 days) or the massive port congestion @ the US Westcoast, which also led to a ripple effect on global basis. The uncertainty about the accessibility of capacity and container equipment going forward, enables carriers to deliver their rate increases by full.

We see global port congestion already increasing – this trend will continue and pick up speed, which provides additional stress to the equipment availability.

The SCFI index on Asia – Europe increased by +40% in a single week.

The global FBX spot index shows a similar development, which illustrates that the cost increases are not limited to the Asia ó Europe trade only.

By now all carriers apply the PSS (or other named surcharges) to all deals – no exceptions. While space is getting tight, we do not have real alternatives. Nevertheless, please only accept the surcharge under formal protest. It starts with the wording of Peak Season Surcharge, which makes absolutely no sense in the context of the Red Sea. Next to this I am concerned that carriers may look to the temporary surcharge to become a firm component of the base rate going forward. It is a situational surcharge only. Once carriers start routing their vessels via the Suez again, we must assume that the risk exposure normalized, and the “peak” (PSS) is over.

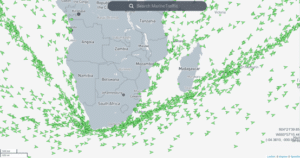

The cargo vessel tracker by Marine Traffic illustrates nicely the intense shipping activities around the Cape of Good Hope.

Carriers start deploying contingency plans to serve Saudi Arabian ports => via the MED resp. the Suez. Once the destination ports are reached the vessels need to go back to the MED via the Suez again, which produces double channel toll costs. Carriers are working via extra loader to break down the backlog. Going forward they will work via feeder vessel services and work via transshipment points like Tanger.

Pls contact our customer service teams for our options.

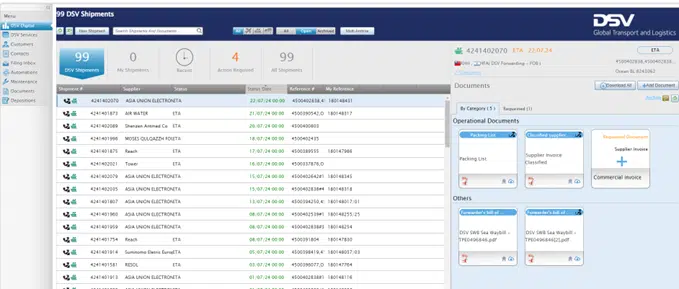

DSV Israel

Latest news

DSV IL – Flash update 03/03/2026

DSV IL – Flash update 02/03/2026

DSV Global Market Update – June 2025

DSV IL – Flash update 13.06.2025

DSV IL – Flash update 09.06.2025

DSV IL – Flash update 03.06.2025

DSV IL – Flash update 22.05.2025

DSV IL – Flash update 5.02.2025

DSV Global Market update – January 2025